Renters Insurance in and around San Antonio

Get renters insurance in San Antonio

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Trying to sift through savings options and providers on top of your pickleball league, work and family events, takes time. But your belongings in your rented home may need the impressive coverage that State Farm provides. So when the unexpected happens, your electronics, furniture and shoes have protection.

Get renters insurance in San Antonio

Coverage for what's yours, in your rented home

Why Renters In San Antonio Choose State Farm

Renters often raise the question: Could renters insurance help you? Think for a moment about what would happen if you had to replace your personal property, or even just a few of your high-value items. With a State Farm renters policy backing you up, you won't waste time worrying about thefts or accidents. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Kami Vidor can help you add identity theft coverage with monitoring alerts and providing support.

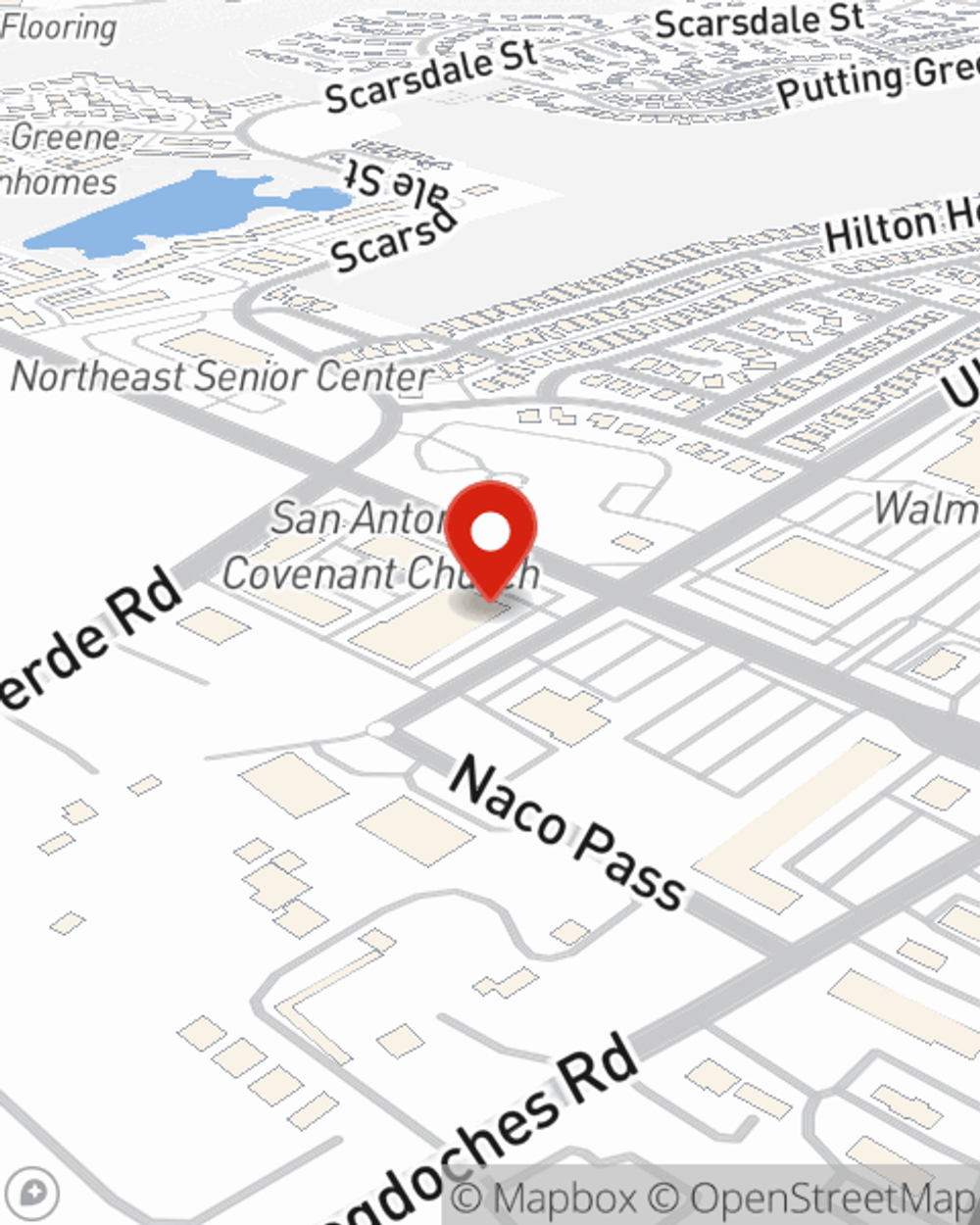

State Farm is a value-driven provider of renters insurance in your neighborhood, San Antonio. Reach out to agent Kami Vidor today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Kami at (210) 655-3276 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.